Innovative Platform for Advanced Distribution of Sustainable Eco-Friendly Fuels

Client Profile

The Client — the Roundtable on Sustainable Biomaterials Association (‘RSB’) — is a global organization driving the transition to a bio-based, circular economy. With over 130 members—including industry leaders, civil society groups, academic institutions, and intergovernmental agencies—RSB provides a world-renowned sustainability framework focused on advancing a biocircular future.

Headquartered in Geneva, Switzerland, RSB delivers impact through its three pillars:

- Membership: Fostering collaboration across sectors

- Programmes: Building capabilities for systemic change

- Certification: Defining and assuring sustainability best practices

Key Challenge

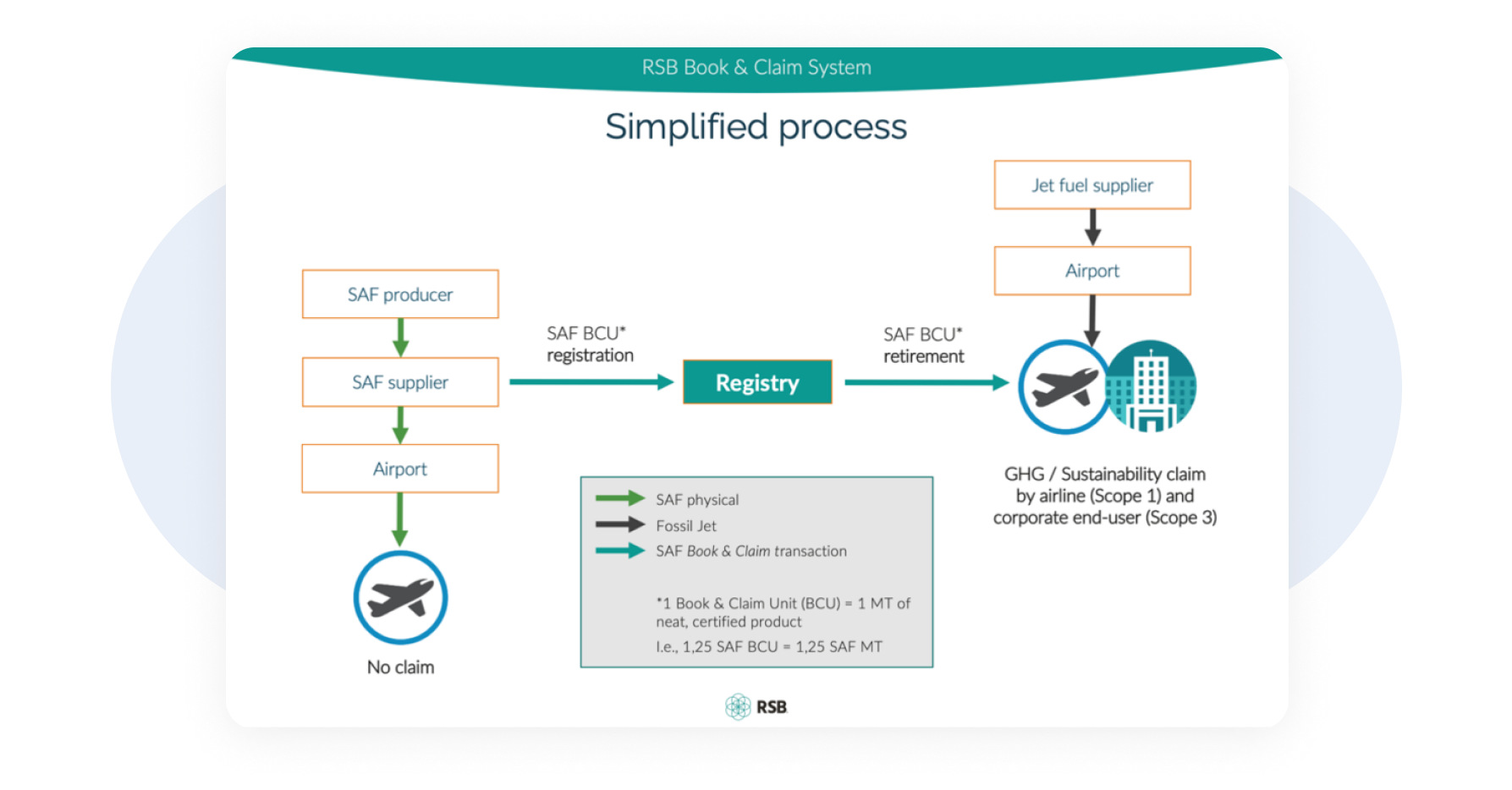

RSB’s mission includes accelerating the decarbonization of hard-to-abate sectors like aviation and maritime shipping. To advance this goal, RSB created the ‘Book & Claim System’ —a novel initiative aimed at scaling the adoption of sustainable, low-emission fuels through an innovative digital mechanism.

To bring this system to life, RSB required a robust, scalable, and secure web platform that would facilitate transactions, issue digital sustainability credits, and enable broad stakeholder participation. Without sufficient in-house development capacity, RSB turned to GP Solutions to design and deliver the solution.

Project Overview

RSB’s Book & Claim System

The Book & Claim System is a virtual marketplace where corporate stakeholders can invest in sustainable fuel production and claim verified environmental benefits—Book & Claim Units (BCUs)—regardless of where the fuel is used. This decouples the environmental benefit from the physical product, creating a more inclusive, accessible, and impactful distribution model for sustainable fuels.

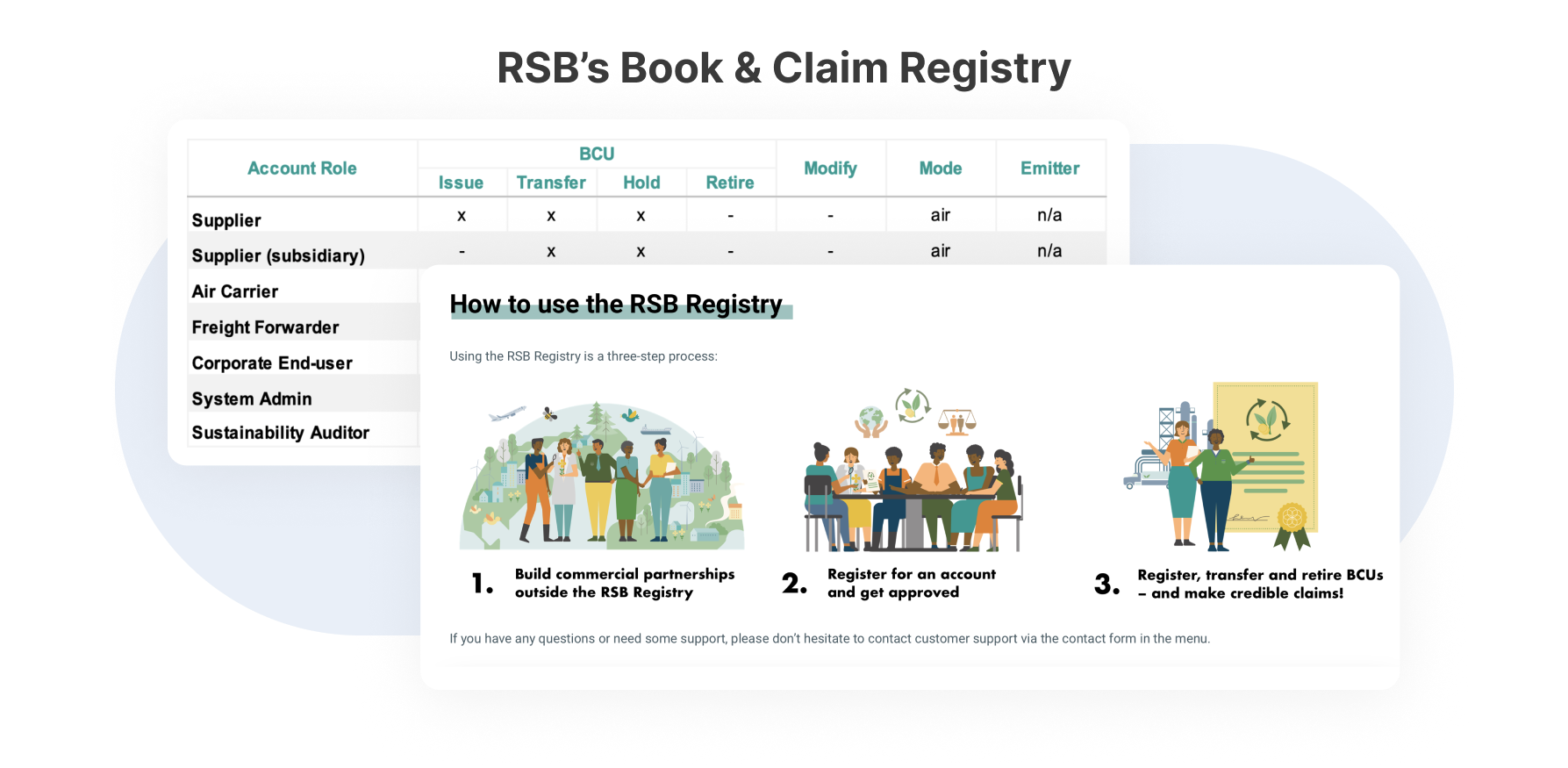

GP Solutions was tasked with building the RSB Book & Claim Registry, a multi-role web application designed to:

- Digitally manage BCU transactions;

- Provide certification of verified emissions reduction;

- Serve as a secure hub for global corporate participants to support clean fuel initiatives.

Key Features and Functionality

Before GP Solutions’ involvement, the process relied on spreadsheets and a basic application. The new digital registry offers:

- A custom, intuitive UI/UX tailored for enterprise users;

- Seamless BCU issuance and transfer mechanisms;

- Enhanced data security, privacy, and administrator oversight;

- A secure certificate issuance system confirming verified participation;

- End-to-end support for ‘Four Eyes Principle’ and two-factor authentication;

- Full audit trail of all credit movements and transaction approvals.

Security-First Architecture

Given the sensitive nature of financial and environmental data, advanced security was paramount. Key security measures included:

- End-to-end data encryption

- Two-factor authentication for all users

- Role-based access control

- Manual admin approvals for all BCU transactions

- ‘Four Eyes’ checks for any account modifications

Technology Stack & Delivery Approach

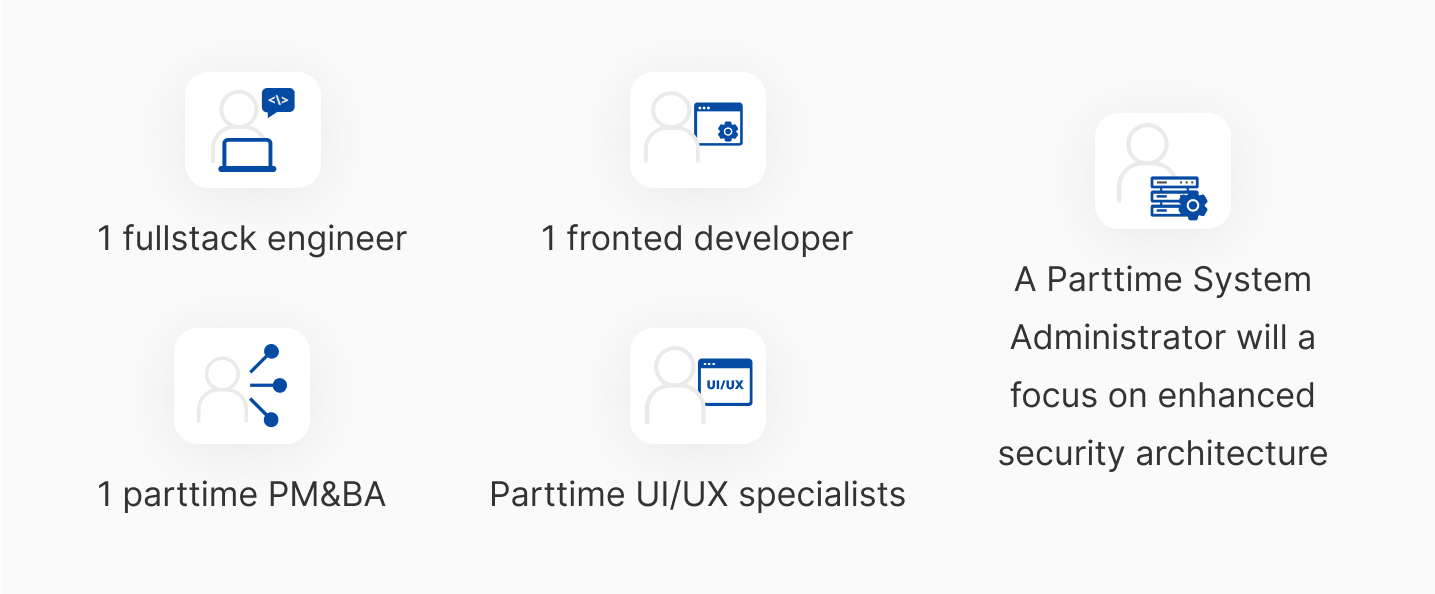

GP Solutions assembled a specialized team comprising:

- 1 Full-stack engineer

- 1 Frontend developer

- Part-time PM & Business Analyst

- Part-time UI/UX specialists

- Part-time System Administrator (security specialist)

The team adopted a React.js frontend, Node.js backend, and MongoDB for data storage. The development process followed Agile/Kanban methodology, ensuring flexibility and continuous collaboration with RSB stakeholders.

Project Milestones & Results

- MVP Delivered: 6 months

- Platform Launch: Autumn 2023

- Public Debut: RSB Annual Conference 2023

The newly launched platform provides a scalable and professional environment for stakeholders to participate in sustainable fuel initiatives. It supports the seamless issuance and claiming of credits, empowering companies to decarbonize operations, even when access to physical fuel is limited.

What’s Next?

- Expansion into maritime fuel transactions

- Integration with major CRMs and external data systems

- Potential blockchain adoption for added transactional transparency

- Future use cases: automotive fuel, industrial bioenergy credits, and more